INVEST IN YOUR CHILDREN’S HIGHER EDUCATION WITH TAX-EXEMPT SSPN

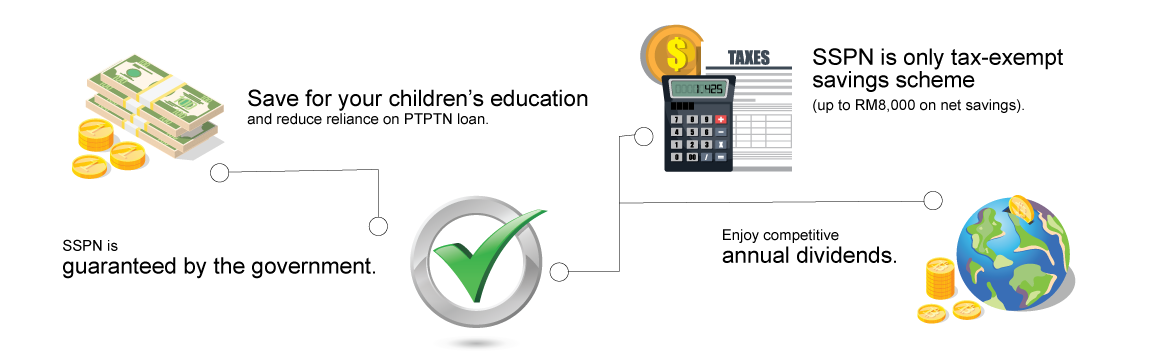

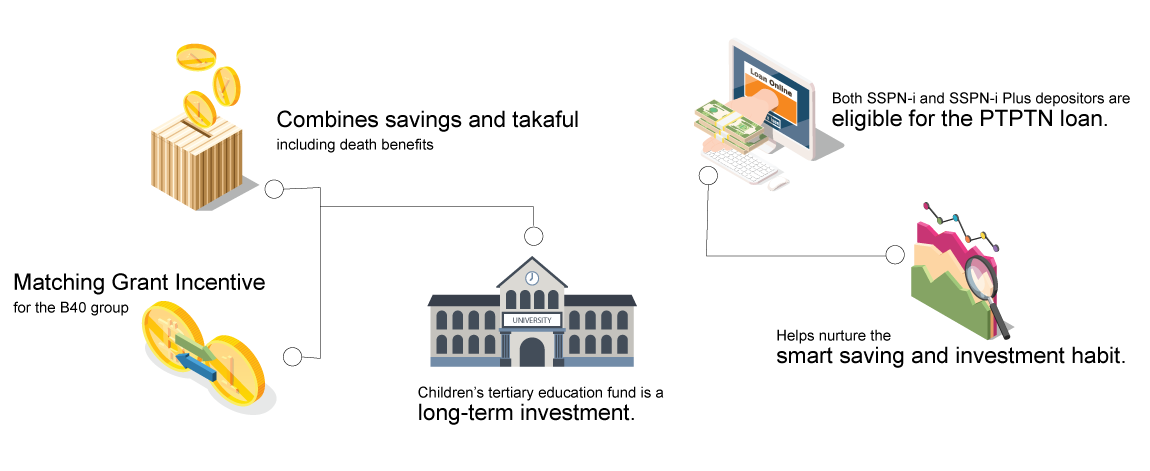

Saving for your children’s education with a tax relief and other incentives is such a big head start on your financial planning. You don’t have to think long when both the SSPN-i and SSPN-i Plus offer an RM8,000 and RM15,000 tax relief with competitive tax-exempt dividends at the same time, respectively.

INVEST IN YOUR CHILDREN’S HIGHER EDUCATION WITH TAX-EXEMPT SSPN

Saving for your children’s education with a tax relief and other incentives is such a big head start on your financial planning. You don’t have to think long when both the SSPN-i and SSPN-i Plus offer an RM8,000 and RM15,000 tax relief with competitive tax-exempt dividends at the same time, respectively.

How to invest in the SSPN scheme?

SSPN-i Plus Online at www.lovesspn.com

PTPTN Branches

PTPTN marketing executives

How to invest in the SSPN scheme?

SSPN-i Plus Online at www.lovesspn.com

PTPTN Branches

PTPTN marketing executives

Who qualifies as the depositor?

Who qualifies as the depositor?

Why invest in the SSPN?

Why invest in the SSPN?

RM8,000 tax relief incentive

Tax deductible amounts are based on the net SSPN savings of the current assessment year.

Tax relief for either a single (joint taxation as a couple) or separate filings (husband and wife to enjoy it separately).

RM8,000 tax relief incentive

Tax deductible amounts are based on the net SSPN savings of the current assessment year.

Tax relief for either a single (joint taxation as a couple) or separate filings (husband and wife to enjoy it separately).

SSPN account summary at your fingertips

for your account statement and income tax filing

SSPN account summary at your fingertips

for your account statement and income tax filing