In today’s tightening economy every little help counts in planning our finances. Perhaps you have a need for emergency funds. However, not everyone is able to get credit facilities from banks. Licensed money lenders are charging interest rates that literally cost an arm and leg. And it’s not always wise to get loans from family and friends. So what are your options?

GoodKredit (GK) is a digital lending platform that provides solution for your emergency cash, in the form of advance pay cash up to RM500 or a microloan up to RM5,000, with fast approval that only takes approximately 24 hours to process. Once the loans are approved and released, you can improve your financial credit score, do a credit card balance transfer, pay bills, top-up your phone and utilize the great deals and offers within the GK merchant community.

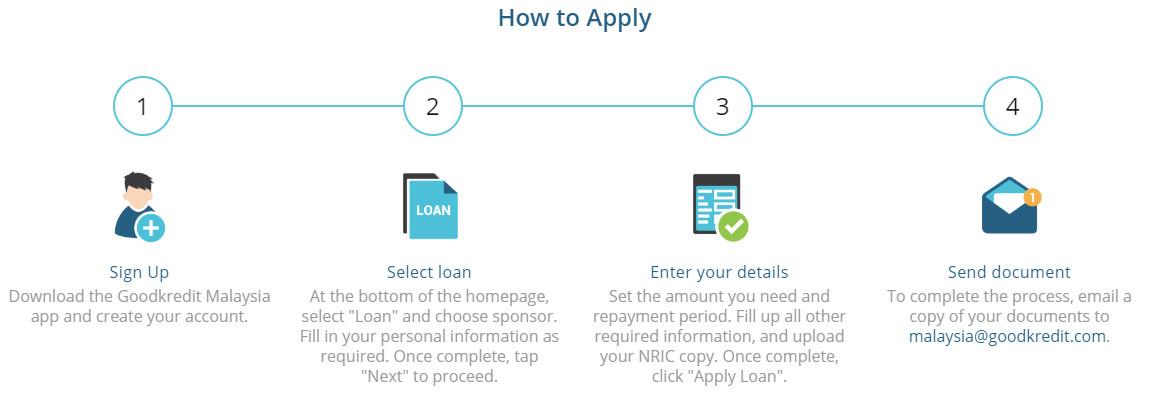

Apply for microloans up to RM5,000 with GK

GoodKredit aims to assist many with its microloans by providing interest fee as low as 15% in town and repayment duration up to 9 months. Sounds too good to be true? Worry not. GoodKredit is all legal, it is essentially the ultimate electronic gift voucher program based on multiple repayment model to solve your financial worries.

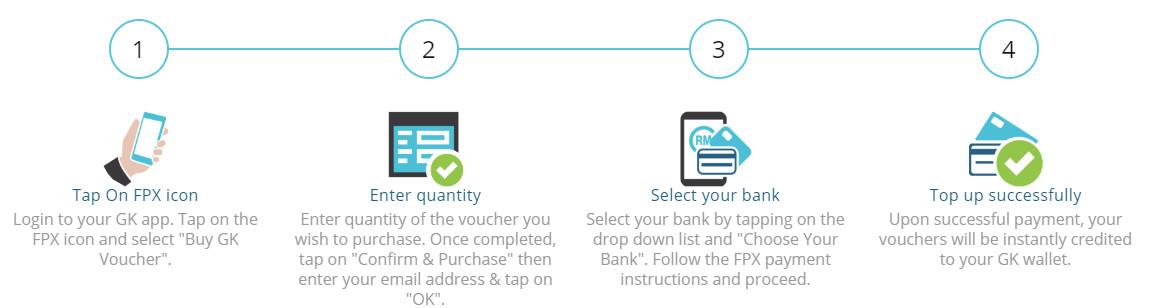

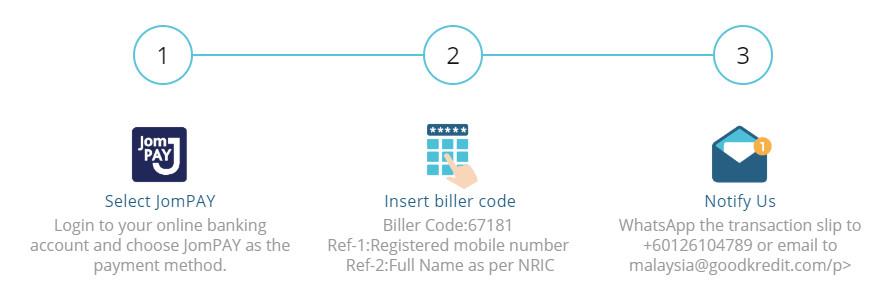

Payment is easy and convenient. You can choose to pay either by FPX or JomPAY with few simple steps as below:

Easy and convenient payment method

All in all, GoodKredit is here to provide assistance to your financial worries or when you need quick emergency cash. To qualify, you must be Malaysian citizen age 21 years and above with a minimum salary of RM 1,500 and a valid Malaysia bank account. A smart consumer will know a good deal when they see one. Don’t miss this chance to get rewarded with GoodKredit today.